By Parveen Karsan & Nazanin Lakani

We are often asked by clients for a simple, easy to understand, description of estate freezes and how they work. While this article endeavours to provide this, there are a number of technical (but extremely important) considerations that are not touched on here. The comments set out in this article do not constitute legal advice. Please consult with your legal advisor prior to entering into an estate freeze.

For the purposes of this article, we will utilize the fictional Mr. X as our taxpayer. Mr. X has heard about estate freezes and is interested in implementing one. For simplicity, we will assume that Mr. X has adult children but no spouse.

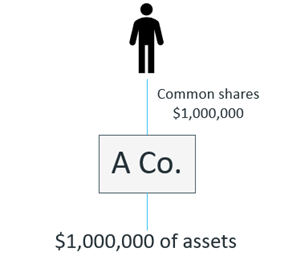

Mr. X’s Current Structure

Some years ago, Mr. X created a business, which we will refer to as “A Co.” Mr. X subscribed for his 10 common shares in the capital of A Co. at a price of $1 per share. Mr. X’s total investment in A Co. was, initially, $10. Mr. X is the sole shareholder of A Co.

Over the years, as a result of Mr. X’s hard work and efforts, the value of A Co. (and, therefore, Mr. X’s 10 common shares in the capital of A Co.) grows steadily. As of today’s date, Mr. X’s 10 common shares in A Co. are worth $1,000,000.

Mr. X’s existing corporate structure may be depicted as follows:

Gains on capital assets held by a taxpayer immediately prior to his or her death are typically realized immediately prior to the death of that taxpayer (with some notable exceptions, including certain transfers of property to a spouse or common-law partner). What does this mean for Mr. X.? Mr. X will be deemed to dispose of all of his capital assets immediately prior to his death for proceeds of disposition equal to the fair market value of the assets at that time. In other words, if Mr. X dies today, he will realize a capital gain equal to $999,990. (That is, $1,000,000 less $10).

Perhaps Mr. X will live for many years yet. During Mr. X’s lifetime, he expects the value of A Co. to continue to increase. Mr. X wants to shelter future growth in respect of the value of the A Co. shares from tax that will otherwise accrue at the time of his passing. In other words, Mr. X wants to take steps to freeze his future tax liability so that, if his A Co. shares increase in value by an additional $3,000,000 during his lifetime, this additional $3,000,000 gain will not be taxable on Mr. X’s death.

An estate freeze is an estate and tax planning tool which allows a taxpayer to lock in the current value (and associated tax liability) of appreciating assets to avoid taxes on the future growth of those assets. Estate freezes are often used by business owners for the generational transfer of their company in a tax-efficient manner. Through an estate freeze, business owners are able to transfer the future growth in the value (and related tax consequences) of their business to other individuals (often their children) while having the option of maintaining control over the operation of the business and the ability to share in its profits.

Simple Estate Freeze

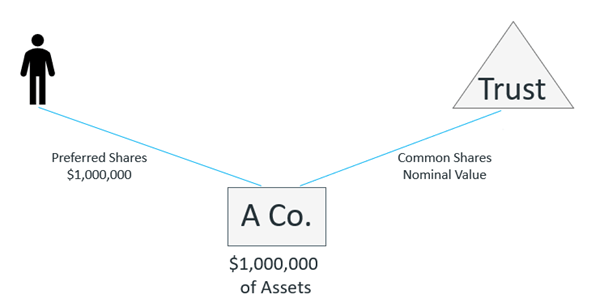

While there are a number of ways of effecting an estate freeze depending on a myriad of factors, Mr. X’s advisors consider Mr. X’s needs and circumstances and recommend the following:

- Mr. X transfers his 10 common shares in A Co. back to A Co.

- A Co. cancels the 10 common shares that previously belonged to Mr. X.

- In consideration for the 10 common shares that A Co. receives from Mr. X., A Co. issues preferred shares in the capital of A Co. to Mx. X. The value of these shares will be fixed at the value of the transferred common shares as of the freeze date. In this case, the value will be $1,000,000. Mr. X receives 1,000 preferred shares, each of which is redeemable at $1,000 per share. Mr. X can ask the company to cancel some or all of these preferred shares in exchange for $1,000 per share over time or as he chooses.

- Since the fair market value of A Co. is now equal to the value of the issued preferred shares (in other words, the value of A Co. is $1,000,000 which is equal to the value of Mr. X’s preferred shares), the net value of A. Co is nil. In other words, the value of A Co., net of the preferred shares issued to Mr. X, is nil.

- A newly established family trust subscribes for new common shares in the capital of A Co. for a nominal subscription price. The new family trust receives 100 common shares of A Co., issued at $1 per share.

The new structure can be depicted as follows:

As the value of Mr. X’s preferred shares is fixed at $1,000,000 (or less, if he has started redeeming his preferred shares), any future growth in value of A Co. will accrue to the family trust (which, as noted, holds the “growth” common shares of A Co.). If the value of A. Co. increases to $4,000,000 during Mr. X’s lifetime, his interest in A Co. will remain frozen at $1,000 per share. If he hasn’t redeemed any preferred shares during his lifetime and therefore still holds $1,000,000 worth of preferred shares, he will be taxed on death on the $999,990 gain in respect of his preferred shares that he would have been taxed on if he disposed of the shares at the time of the freeze. (Yes – it does get more complicated than this. Please be sure to consult your tax advisor).

The remaining $3,000,000 of growth will accrue to the family trust. If the beneficiaries of the family trust are the children of Mr. X, the family trust may eventually distribute the new common shares to them. They will not have to pay tax on the $3,000,000 gain until they dispose of the shares or die. Mr. X has potentially deferred tax on the $3,000,000 by an entire generation.

Benefits of an Estate Freeze:

- Transferring Future Growth: Through an estate freeze, the future appreciation of the transferred shares will be linked to the newly issued common shares of the Company. This means that any increase in the value of the Company post-freeze will be attributed to the holders of the newly issued common shares.

- Tax Efficiency: The business owner’s capital gains tax liability is frozen at the current value of the shares. Future growth, and hence future tax liabilities, are transferred to the next generation.

- Reduction of Probate Fees: An estate freeze can reduce probate fees by limiting the size of a taxpayer’s estate.

- Retention of Control and Income: The business owner has the option to retain control and profit-sharing rights in the Company by assigning voting and dividend rights to the preferred shares received as a result of an estate freeze.

- Income Splitting: After an estate Freeze, the business owner can engage in income splitting by distributing dividends from the Company to family members in lower tax brackets.

The 21-year rule must be considered if a family trust is used. Specifically, a family trust is deemed, for tax purposes, to have disposed of its assets on the 21st anniversary of the trust’s creation date. This triggers capital gains taxes on accrued gains in respect of any assets held by the trust on its 21st anniversary date. Therefore, where a family trust is used for an estate freeze, taxpayers should plan for this (eg. by having the assets of the trust distributed to the beneficiaries prior to the 21st anniversary of the creation date of the trust) or other tax planning should be undertaken to avoid the triggering of tax on the 21st anniversary date.

Again, if considering an estate freeze, please consult with a tax professional.